Complete and submit a tax form

Learn how you can add and fill out your tax forms in RAMP.

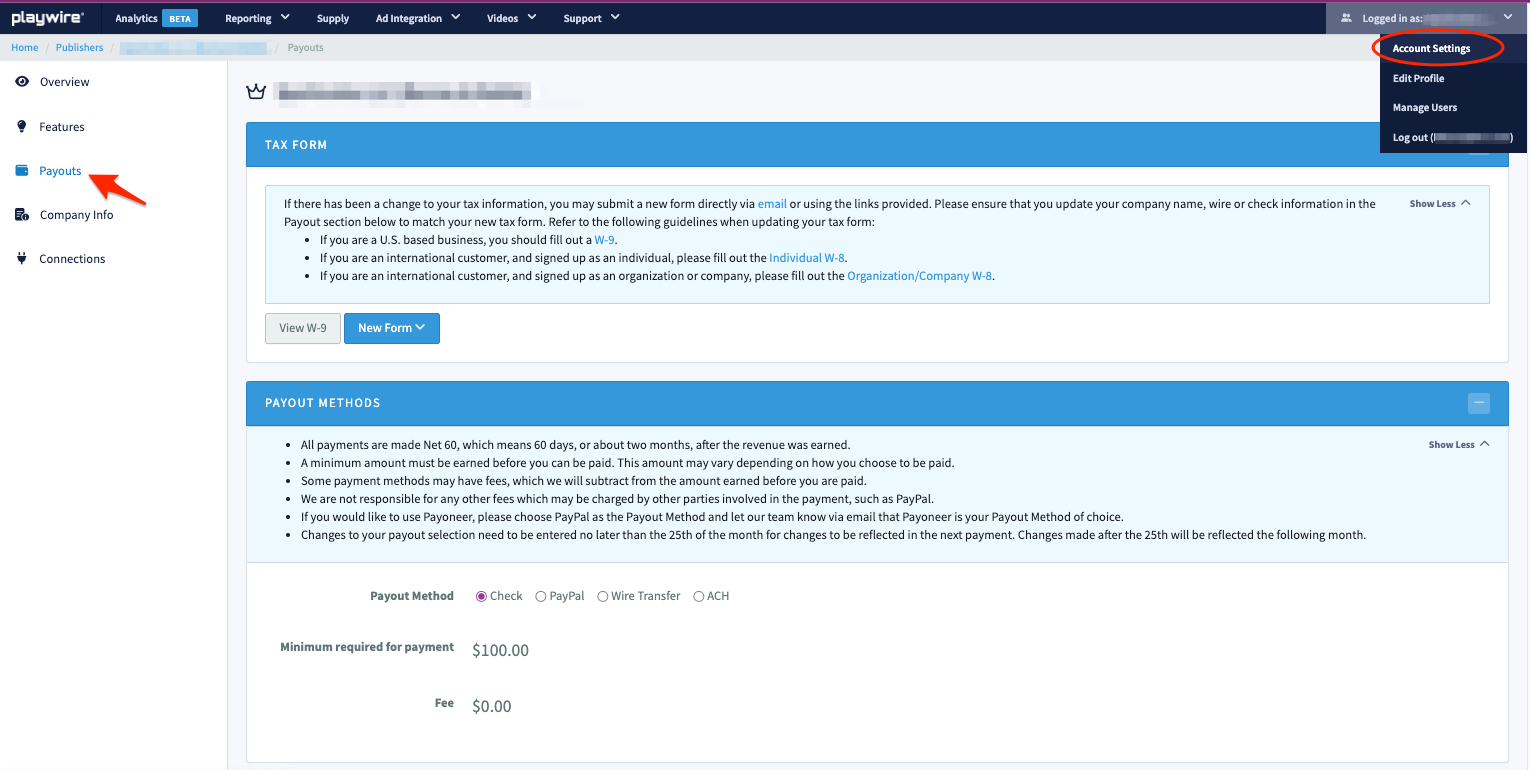

For Playwire to remit your payment, you must fill out and submit a valid tax form. You can do this by doing any of the following:

-

Go to Account Settings > PAYOUT in RAMP and fill out the form.

-

If you have a previously completed tax form, you can email it to your Account Manager directly.

-

You can download and/or fill out the form directly from the IRS website. See W-9 form, W-8 BEN form, and W8- BEN E form for reference.

Your Account Manager will contact you with any questions about the form. Our Finance team will review and approve the tax forms. They may not approve your tax form if it’s not completed correctly.

Important note about the address

When filling out the form, enter the details in the corresponding fields. For example, street and apartment or suite details should be in the Address (number, street, and apt. or suite no) field, etc. If not done correctly, your form will not be approved.

Before you begin

-

If you're in the U.S., complete and submit a standard W-9 form. Go to the corresponding section below for the steps.

-

If you're outside the U.S., complete and submit a W-8 form.

-

For individuals outside the U.S., use the individual W-8 tax form (W-8BEN). Go to the corresponding section below for the steps.

-

For organizations outside the U.S., use the Organization/Company W-8 form (W-8BEN-E). Go to the corresponding section below for the steps.

-

-

If you have a previously completed tax form, email it to your Account Manager or onboarding specialist.

-

If you have completed a tax form in RAMP that needs correction, you must fill out a new form in its entirety. Make sure to pay special attention to all the directions.

Complete a W-9 form (for U.S-based publishers)

-

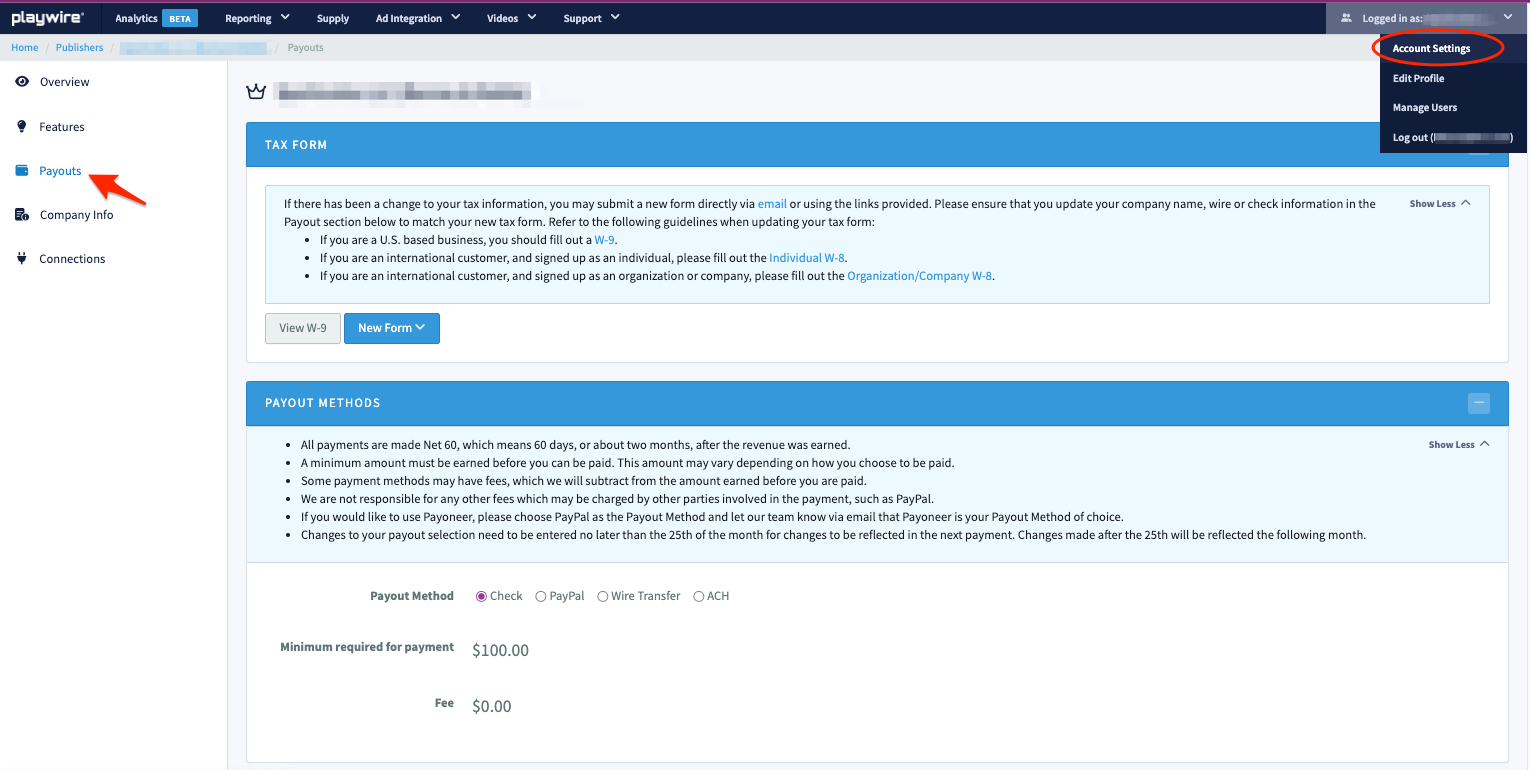

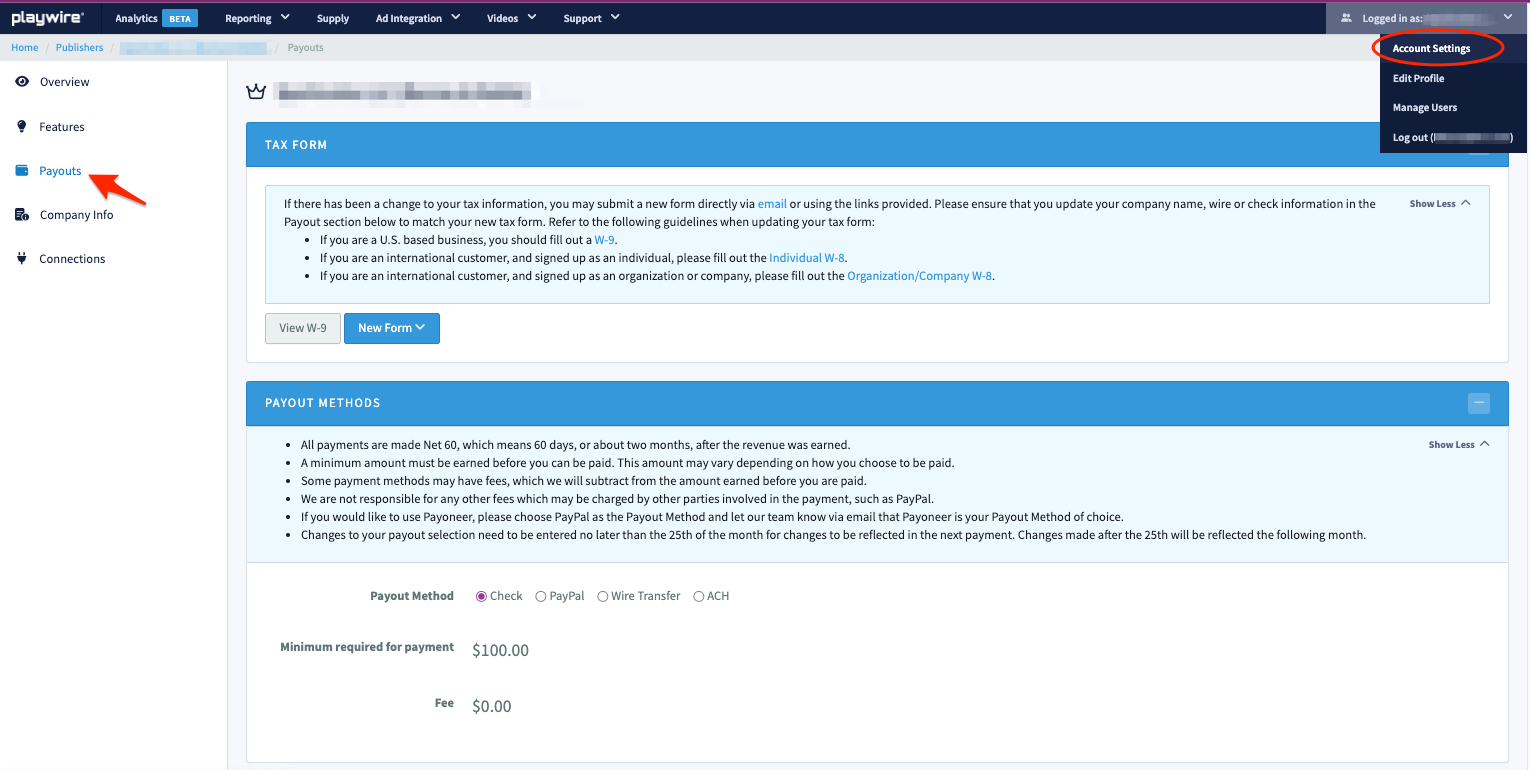

Click the user profile icon and go to Account Settings > Payouts.

-

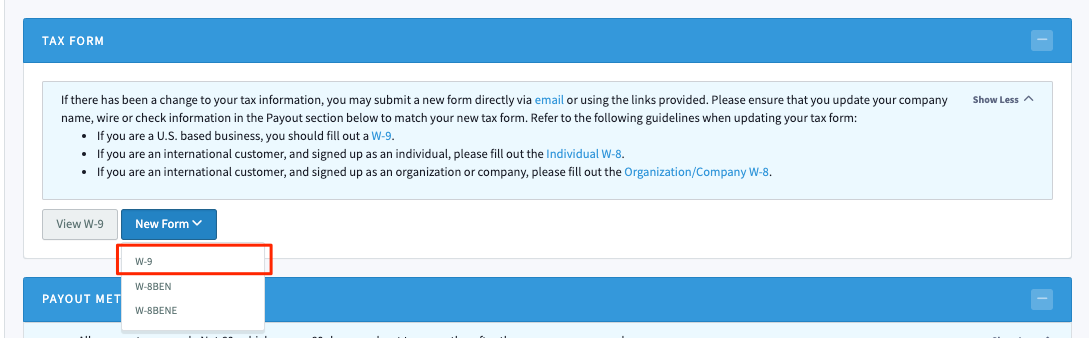

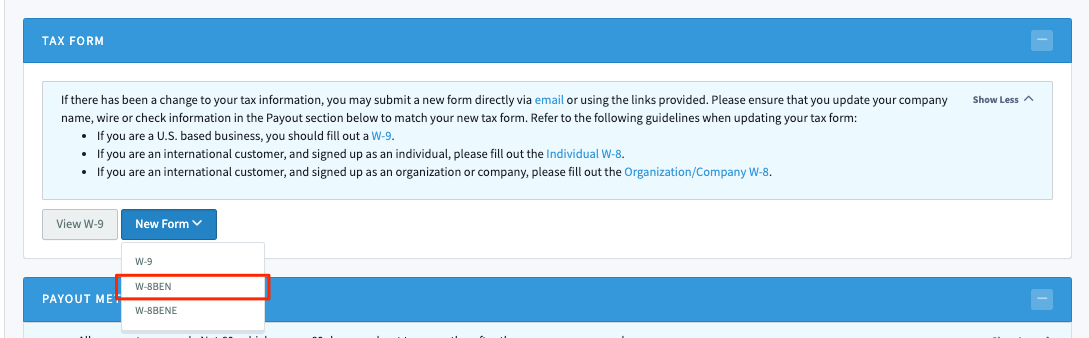

Under TAX FORM, use the New Form dropdown and select W-9.

-

Click CONTINUE to start filling out the form.

-

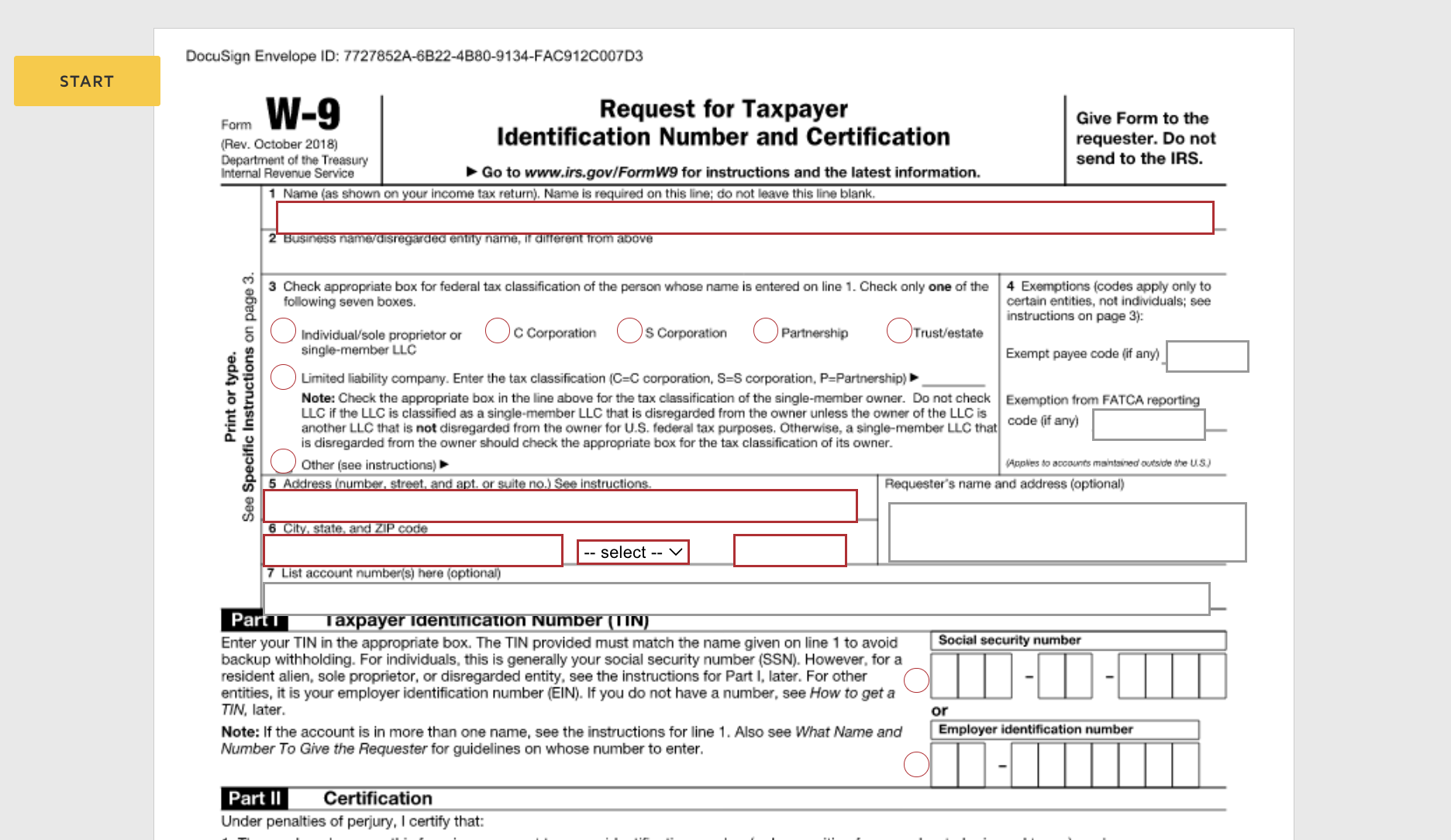

Enter the required fields (highlighted in red) by clicking the corresponding line.

-

In Line 1, enter the name shown on your tax income return.

-

In Line 3, check the appropriate box for federal classification for the person entered in Line 1.

If you're an LLC, you must enter the tax classification of the LLC in the blank area, which can be a partnership (P), corporation (C), or S corporation (S). -

In Line 5, enter your street number, street name, apartment or suite number (if applicable).

-

In Line 6, enter the city name and ZIP code. Use the dropdown to select your state.

Important notes about the address

-

Make sure to enter the details in the corresponding fields. For example, street and apartment or suite details should be in the Address (number, street, and apt. or suite no.) field, etc. If not done correctly, your form will not be approved.

-

If choosing wire for your payment method, this address must match the payment account holder's address in RAMP.

-

-

In Part I - Taxpayer Identification Number (TIN), enter the TIN for the person entered in Line 1, which can be any of the following:

-

If you entered a non-company (individual) name in Line 1, enter the Social Security Number (SSN).

-

If you entered the company’s name in Line 1, enter the employer identification number (EIN).

-

If you’re a sole proprietor or you filled in Lines 1 and 2, you can enter either the EIN or SSN.

-

See the IRS documentation for more information.

-

-

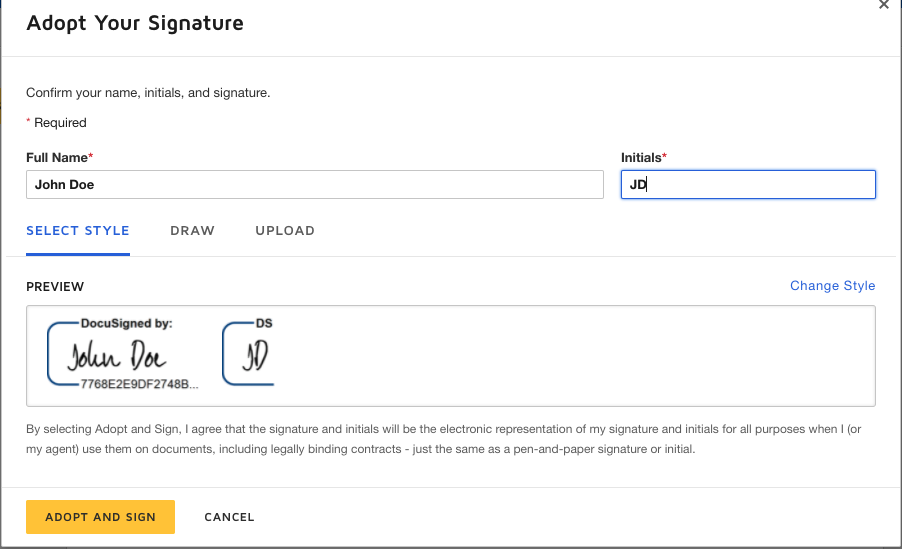

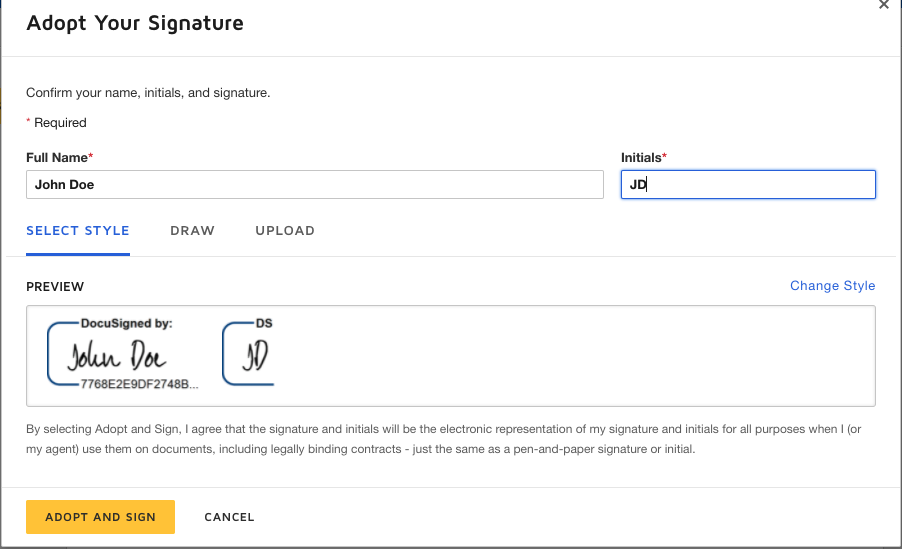

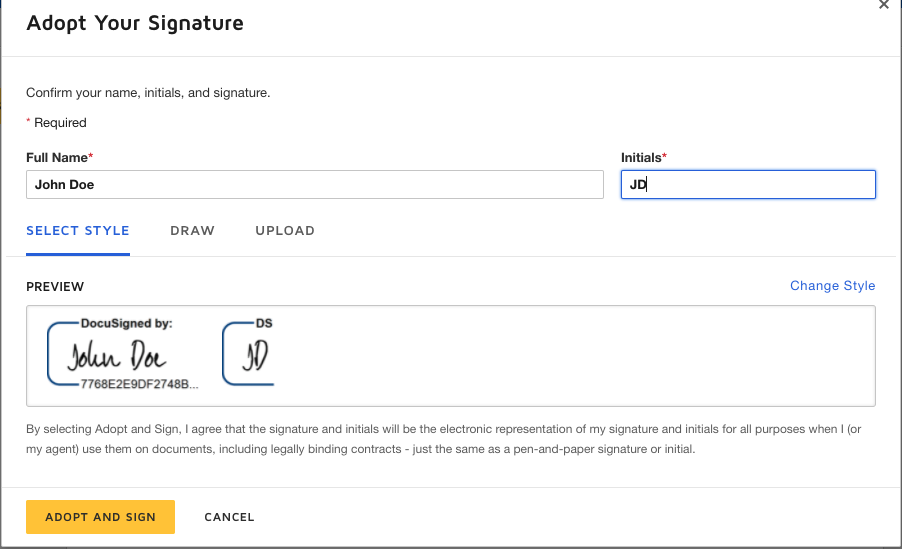

In Part II - Certification, click Sign to select and confirm your signature.

-

When done, click ADOPT AND SIGN.

-

-

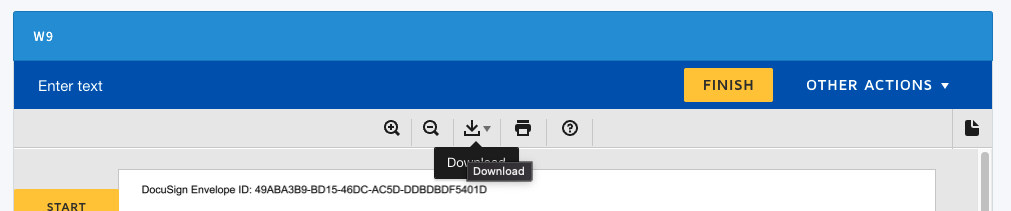

To get a copy of the completed tax form, click the Download or Print icon.

-

After completing the form, click FINISH. Your form is now submitted to Playwire for review.

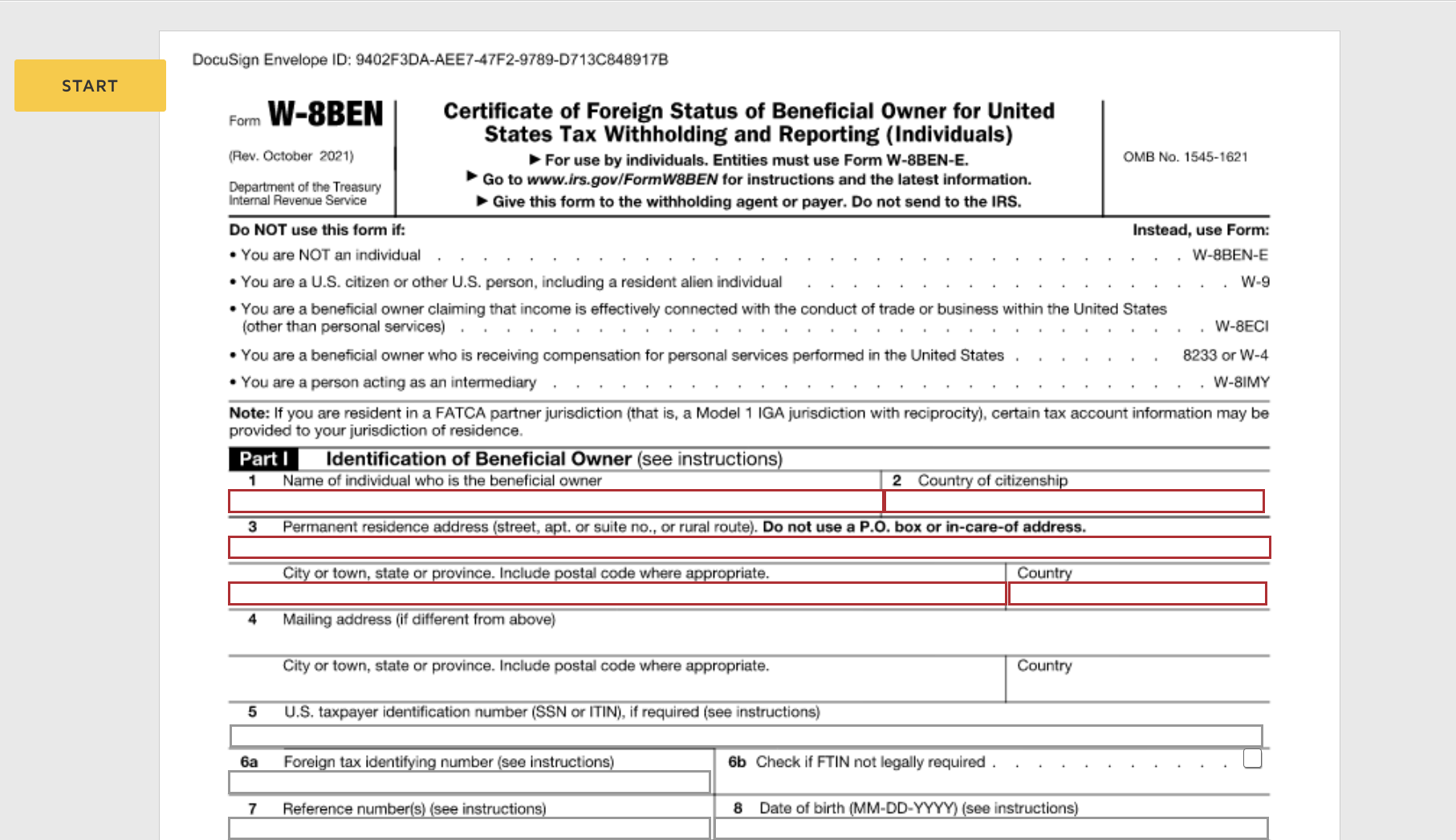

Complete a W-8 BEN form (for non-US individual publishers)

-

Click the user profile icon and go to Account Settings > Payouts.

-

Under TAX FORM, use the New Form dropdown and select W-8BEN to open the document.

-

Click CONTINUE to start filling out the form.

-

In Part I - Identification of Beneficial Owner, enter the required fields (highlighted in red) by clicking the corresponding line.

-

(Required) In Line 1 Name of individual who is the beneficial owner, enter the owner's name. An owner is defined as a legal owner who pays the necessary taxes in their country.

-

(Required) In Line 2 Country of citizenship, enter the country of citizenship of the owner.

-

(Required) In Line 3 Permanent residence address, enter the owner's street number, street name, apartment or suite number (if applicable), city or town name, state or province, and postal code.

Important note about the address

Make sure to enter the details in the corresponding fields. For example, street and apartment or suite details should be in the Address (number, street, and apt. or suite no.) field, etc. If not done correctly, your form will not be approved.

-

-

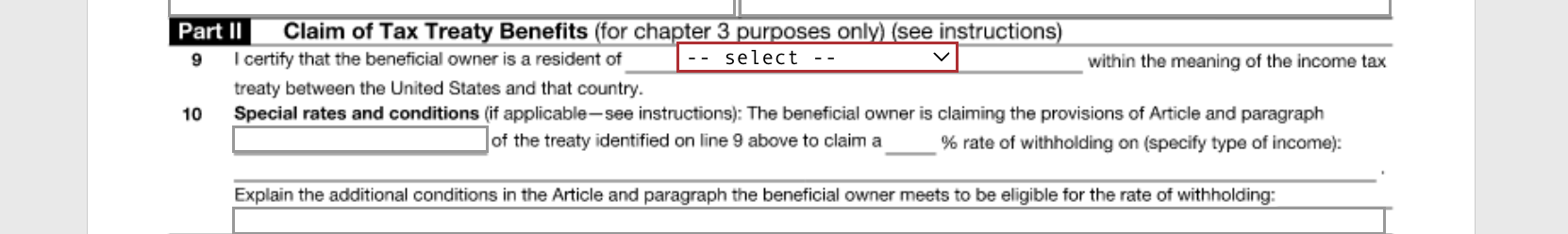

In Part II - Claim of Tax Treaty Benefits, use the dropdown to select your country. See the IRS documentation to check if your country is part of the tax treaty with the US. If your country is NOT a part of the tax treaty, select Not Applicable, which you can find at the end of the dropdown choices.

-

In Part III - Certification, click Sign so you can select and confirm your signature.

-

When done, click ADOPT AND SIGN.

-

To get a copy of the completed tax form, click the Download or Print icon.

-

After completing the form, click FINISH. Your form is now submitted to Playwire for review.

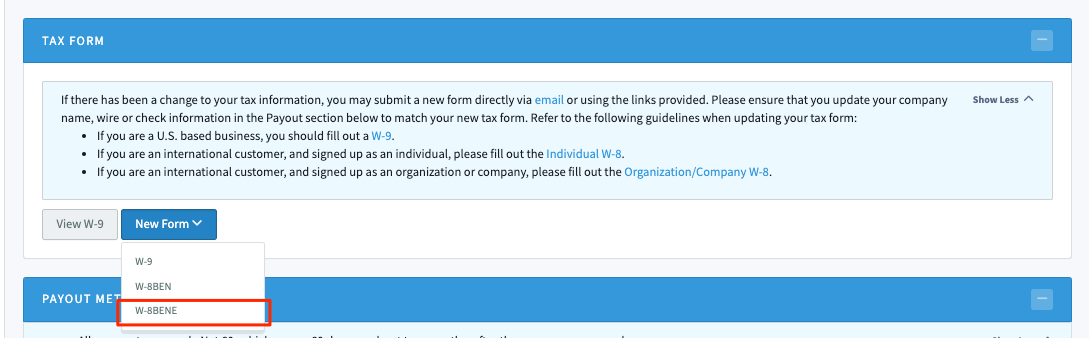

Complete a W-8 BEN E form (for non-US company publishers)

-

Click the user profile and go to Account Settings > Payouts.

-

Under TAX FORM, use the New Form dropdown and select W-8BENE to open the document.

-

Click CONTINUE to start filling out the form.

-

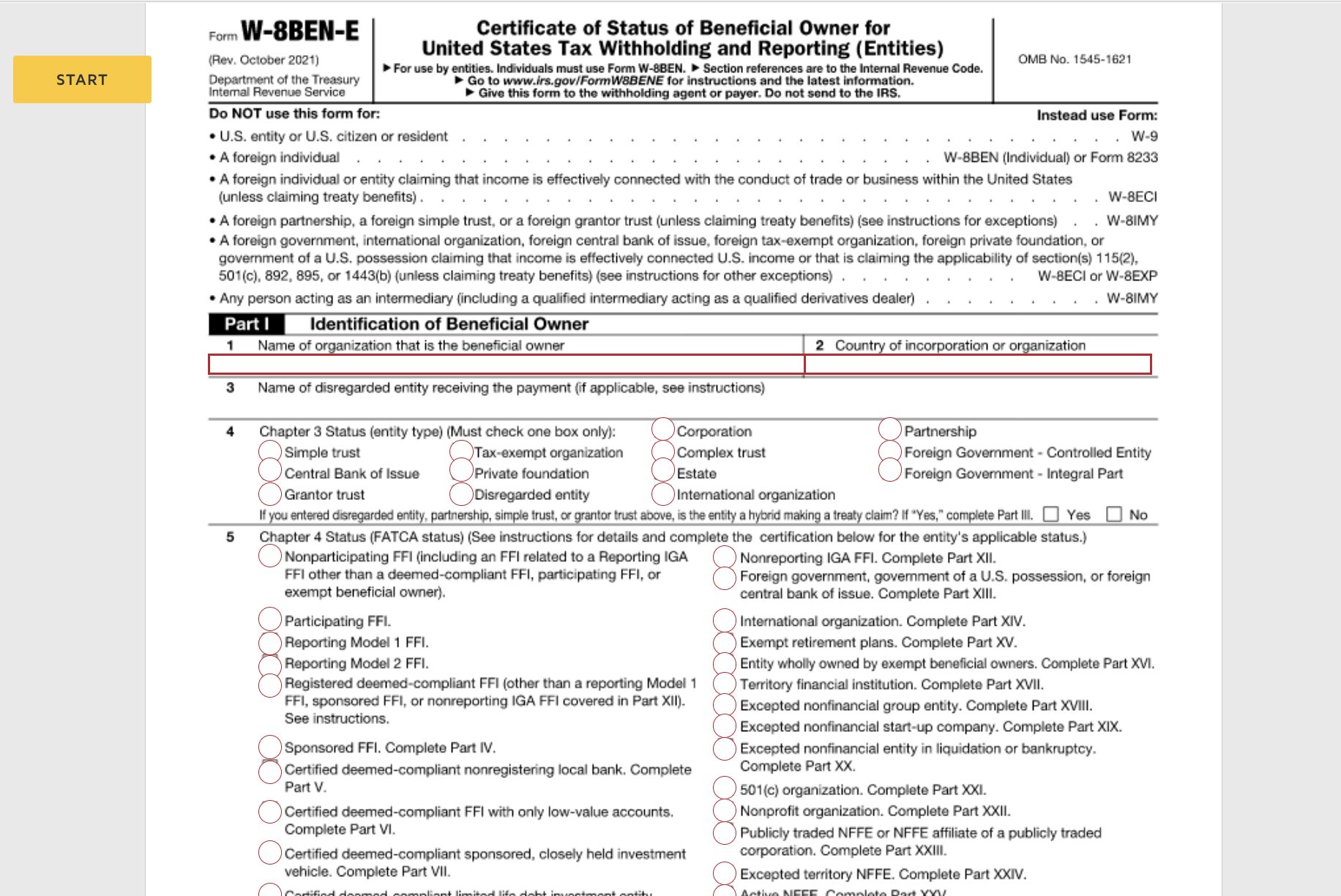

In Part I - Identification of Beneficial Owner, enter the required fields (highlighted in red) by clicking the corresponding line.

-

(Required) In Line 1 Name of organization that is the beneficial owner, enter the company's legal name, which should be the same name as in your country's tax return.

-

(Required) In Line 2 Country of incorporation or organization, enter the country of incorporation.

-

(Required) In Line 4 - Chapter 3 Status, check the box applicable to your company. You must check one box only.

-

(Required) In Line 5 - Chapter 4 Status, check the FATCA status applicable to your company. You must check one box only. Ask your accountant or tax advisor if you have any questions about your company's FATCA status.

Note

You must complete the corresponding certification based on the status you checked. For example, if you picked "Sponsored FFI", you must go to Part IV of the document and complete the details. In this case, when you go to Part IV, the fields will automatically be editable.

-

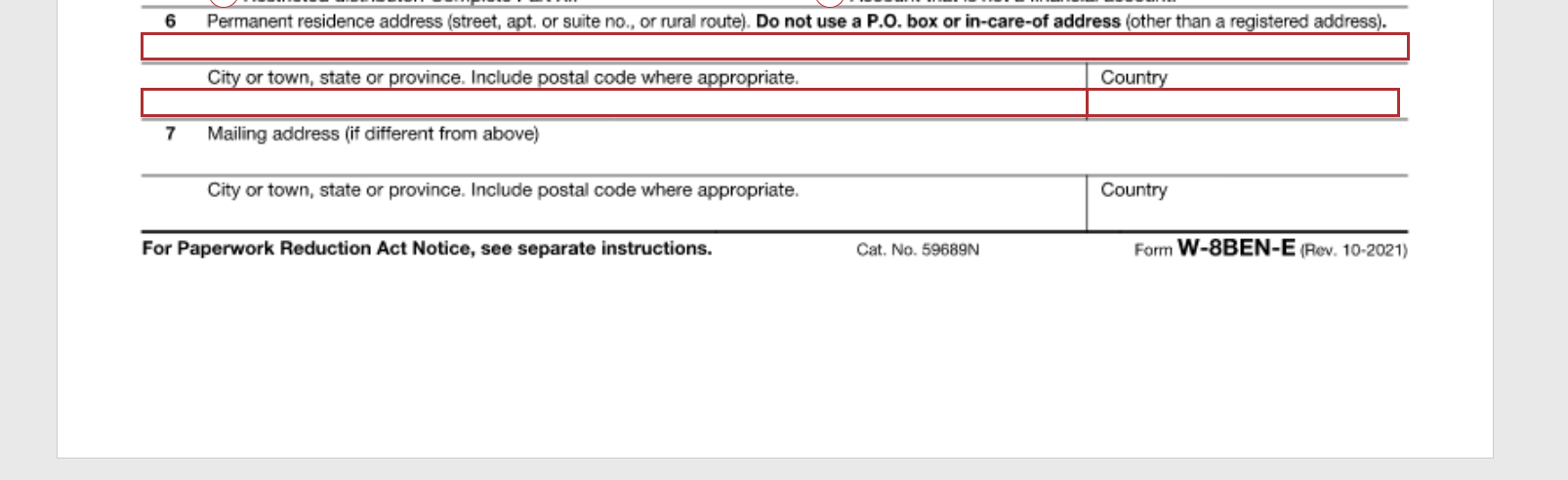

In Line 6 Permanent residence address, enter the company's street number, street name, apartment or suite number (if applicable), city or town name, state or province, and postal code.

Important note about the address

For example, street and apartment or suite details should be in the Address (number, street, and apt. or suite no.) field, etc. If not done correctly, your form will not be approved.

-

-

In Part III - Claim of Tax Treaty Benefits, select the checkbox that applies to you. Select the a [ ] The beneficial owner is resident ofcheckbox if your country is in an income tax treaty with the U.S.

-

Use the dropdown to select your country. See the IRS documentation to check if your country is part of the treaty. If your country is NOT part of the treaty you can leave it as -- select --.

-

-

In Parts IV - XXIX, complete the details required. The part you need to complete depends on the status you checked in Line 5 - Chapter 4 Status (FATCA Status).

-

In Part XXX - Certification, click Sign to select and confirm your signature.

-

When done, click ADOPT AND SIGN.

-

To get a copy of the completed tax form, click the Download or Print icon.

-

After completing the form, click FINISH. Your form is now submitted to Playwire for review.

What's next?

Once the tax form is submitted, our Finance team reviews it for accuracy. When approved, you should see a confirmation message in RAMP. Your Account Manager will contact you if there are any questions or need clarification about the form.

To learn more about how to set up payment in RAMP, see Select your payment method.

-1.png?width=100&height=75&name=1-playwire-logo-primary-2021%20(1)-1.png)